Five Things to Know About The Economy

Uncertainty has shaped economic conversations throughout 2025 but signs of weakness in the economy have only started to materialize in the hard data recently. While job growth was steady in the first quarter of the year, the months that followed have been slower. In June 2025, the U.S. economy reported losing jobs (on net) for the first time since December 2020. Slower job growth, along with fewer job openings, suggest weakening demand for workers, making it harder to find a job for those who are looking. While inflation was trending downwards, there was slight acceleration in May, June, and July. Fortunately, none of these dynamics appear to have triggered widespread layoffs, so far. Consumers appear pessimistic about economic conditions, while small business owners generally appear positive.

Here are five things to know about the economy as of October 9, 2025.

U.S. Tariffs on Track to Hit 84-Year High Under Current Proposals, Tax Foundation Says

The Kentucky Chamber hosted a webinar on June 9, 2025, featuring Vice President of Policy Charles Aull and Erica York, Vice President of Federal Tax Policy at the Tax Foundation, to explore how tariff and tax policies in Washington are shaping the economic landscape for Kentucky businesses.

Watch the webinar below:

Read The Full Story on The Bottom Line

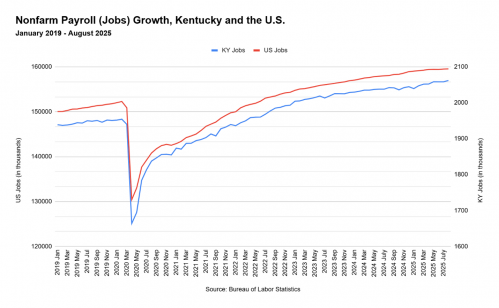

Job Growth

Job Growth in Kentucky Remains Relatively Steady, While National Job Growth has Begun to Stall.

- Between August 2024 and August 2025, Kentucky employers added 19,800 new jobs. By comparison, Kentucky employers added 23,100 new jobs between August 2023 and August 2024.

- Kentucky employers surpassed 2 million jobs on record for the first time in state history in January 2023. As of August 2025, Kentucky had 2,062,200 recorded jobs.

- Nationwide, job growth was steady in the first four months of 2025, producing more than 100,000 jobs each month from January to April.

- National job growth began slowing in May. In June 2025, the economy shed 13,000 jobs – the first negative monthly jobs reading since December 2020.

- In August 2025, U.S. employers added 22,000 new jobs.

- Due to the federal government shutdown, the monthly employment report for September – which was scheduled for October 3, 2025 – has not yet been released.

- Estimates for September from private companies that routinely release proprietary monthly employment estimates include a loss of 32,000 jobs (AD), a gain of 17,000 jobs (Carlyle), and a gain of 60,000 jobs (Revelio Labs).

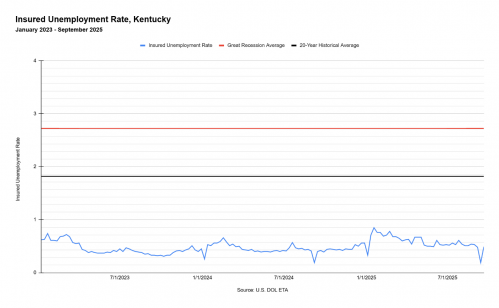

Layoffs

Despite Slower Job Growth, Layoffs Remain Relatively Low.

- Claims for unemployment insurance benefits in Kentucky increased in early 2025 but have been generally flat since then and remain low by historical standards.

- Many workers claim unemployment insurance benefits when they lose their job through no fault of their own – such as layoffs. Low rates of claims suggest that layoffs are still relatively limited despite recent upticks.

- One of the positives of low rates of unemployment insurance claims is that the balance of the state’s Unemployment Insurance Trust Fund was more than $1.117 billion as of October 8, 2025. This helps ensure that the state is well prepared to support laid-off workers in the event that the economy experiences a downturn.

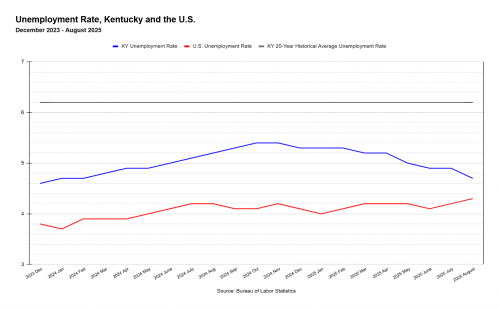

Unemployment & Hiring

Kentucky's Unemployment Rate Has Decreased Since May 2025, as the Size of Our Workforce Has Decreased. National Unemployment Has Been Ticking Up. It Is Getting Harder for Unemployed Adults to Find a Job.

- Kentucky’s unemployment rate rose in 2024 but has declined throughout 2025, registering at 4.7% in August 2025. Unemployment in the state remains below Kentucky’s 20-year historical average.

- The national unemployment rate is typically lower than Kentucky’s, registering at 4.3% in August 2025. This was up from 4.0% in January 2025. There were 7.3 million unemployed adults in the U.S. in August 2025.

- The unemployment rate measures the percentage of adults in the workforce who don’t have a job but are actively looking for one. The unemployment rate can rise and fall due to layoff and hiring activity but also because of more or fewer jobless adults looking for work.

- Unemployed adults are part of the workforce. As of August 2025, Kentucky’s total workforce was 2,114,861 workers, including 2,014,738 employed workers.

- The size of Kentucky’s workforce declined by 4,850 workers between May 2025 and August 2025, which may explain why the state’s unemployment rate has decreased during this period. Some unemployed workers stopped looking for work during this time period.

- Unemployment levels are frequently compared to reported job openings as one way of assessing how easy or difficult it may be to find a job. In Kentucky, there were 103,000 reported job openings in July 2025 compared to 102,955 unemployed workers that same month. Nationally, in July, there were 7.181 million reported job openings vs. 7.384 million unemployed workers.

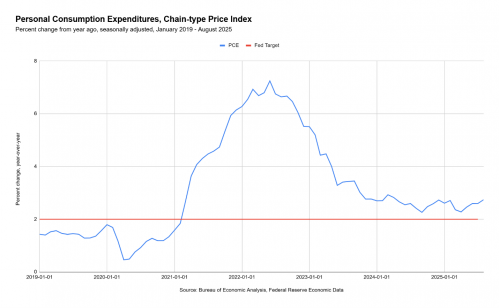

Inflation

Inflation Has Eased Since 2022, But Has Ticked Up Recently.

- U.S. inflation rose 2.74% from August 2024 to August 2025, which is above the Federal Reserve’s 2% target.

- Inflation has eased since June 2022’s 7.2% peak but remains a key issue for consumers and businesses. Measured year-over-year, inflation rose in May, June, July, and August 2025.

- This measure of inflation is the personal consumption expenditure index (PCE), which is the preferred inflation measurement for the Federal Reserve. It is different from the more commonly known consumer price index (CPI) in that it more effectively accounts for changes in consumer behavior. Read more here.

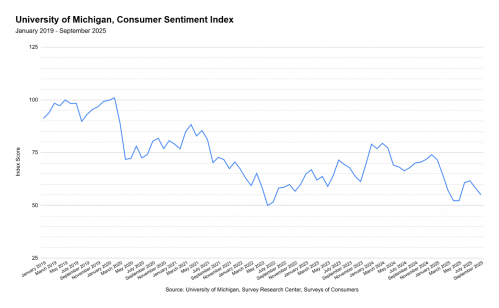

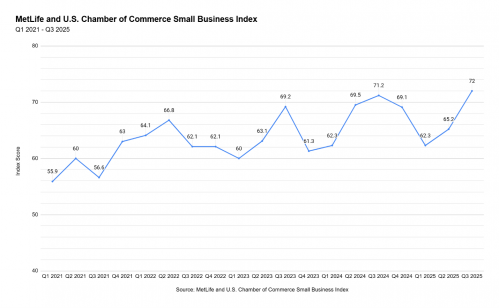

Consumer and Business Sentiment

While Small Business Owners Remain Mostly Positive.

- Similarly, small business optimism rose throughout 2024 but fell in the first quarter of 2025. However, optimism among small business owners rebounded in the second and third quarters, setting an all-time high in the MetLife & U.S. Chamber of Commerce Small Business Index.

About This Data

On this web page, we provide economic updates on Kentucky and the United States, using a range of key metrics from the U.S. Department of Labor, U.S. Bureau of Economic Analysis, the University of Michigan, the St. Louis Federal Reserve, and the U.S. Chamber of Commerce. All data is analyzed by the Kentucky Chamber Center for Policy and Research. On this page, we cover jobs, unemployment, unemployment insurance claims, hiring, workforce participation, inflation, consumer sentiment, and small business optimism.

Sources

Federal Reserve Bank of St. Louis, Federal Reserve Economic Data

MetLife and U.S. Chamber of Commerce, Small Business Index

University of Michigan, Survey Research Center, Surveys of Consumers

U.S. Bureau of Economic Analysis, Personal Consumption Expenditures Price Index

U.S. Bureau of Labor Statistics, Local Area Unemployment Statistics

U.S. Bureau of Labor Statistics, Labor Force Statistics from the Current Population Survey

U.S. Department of Labor, Employment and Training Administration, Unemployment Insurance Data

U.S. Federal Reserve, Economy at a Glance – Inflation (PCE)

ADP Employment Report

Carlyle

Revelio Labs